For car enthusiasts, collectors, and everyday drivers of high-value vehicles, one question often sparks serious curiosity: how do people register their cars in Montana and save thousands in taxes? From exotic supercars to motorhomes and custom restorations, owners across the U.S. are discovering that setting up a Montana LLC offers a recognized compliant pathway to minimize costs and streamline ownership.

At its core, a Montana LLC is a limited liability company formed in the state of Montana that can hold the title to your vehicle. By registering through this entity, you avoid paying state sales tax on the purchase of cars, trucks, RVs, or motorcycles—a significant advantage in states where taxes can climb into the tens of thousands. It’s a strategy that has made Montana LLCs especially popular for luxury and exotic cars, but it’s equally valuable for RV owners, collectors, and anyone seeking long-term savings.

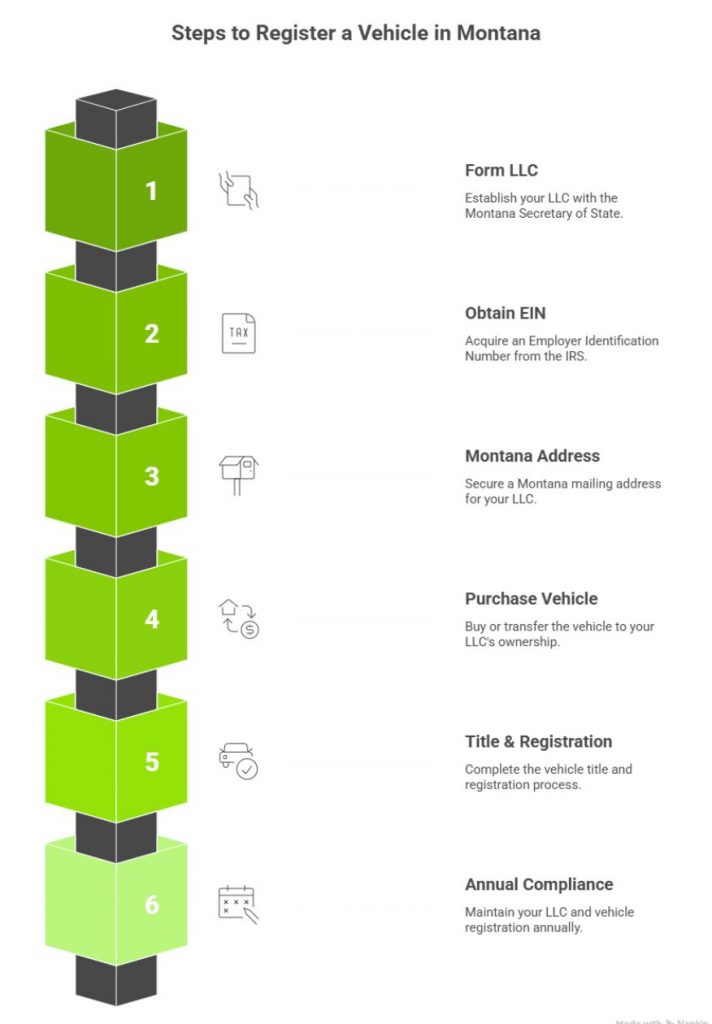

In this guide, you’ll learn exactly how the process works. From forming your LLC to transferring vehicle ownership and maintaining compliance, we’ll walk through each step in detail. Along the way, we’ll reference authoritative resources so you know exactly where to go to get it done right.

Section 1: What Is a Montana LLC for Cars?

A Montana LLC, or limited liability company, is a business entity established under Montana state law. While LLCs are typically used to run companies, Montana has become famous for another use: holding vehicle titles. Instead of buying or registering a car in your personal name, you can form an LLC in Montana, make the LLC the official owner of the vehicle, and register it with Montana plates.

The reason this approach is so attractive stems from Montana’s unique tax laws. Unlike most states, Montana does not charge sales tax on vehicles. That means a $100,000 car that might come with a $7,000–$10,000 sales tax bill elsewhere could be purchased or transferred into a Montana LLC without that extra cost. For exotic and luxury cars where sales tax alone can reach six figures, the savings are immense.

Beyond the tax advantage, Montana LLCs also provide:

- Privacy – The LLC owns the car, not your personal name, which can help protect your identity.

- Flexibility – You can title, register, and insure vehicles under the LLC, often across multiple cars.

- Simplified Registration – Montana’s DMV system makes it easier to register vehicles without many of the restrictions found in other states.

In short, a Montana LLC turns vehicle ownership into a strategic financial move. It’s a structure that’s both practical and cost-effective, provided you follow the correct steps and remain aware of how your home state may view the arrangement.

Section 2: Step-by-Step Guide to Starting a Montana LLC for Cars

Starting a Montana LLC for vehicle ownership may sound complicated, but the process is straightforward once broken down into clear steps. Here’s how to do it:

Step 1: Form Your Montana LLC

The first step is establishing your LLC with the Montana Secretary of State.

- Choose a Name – Your LLC name must be unique, not already in use, and must include a business designation such as “LLC” or “Limited Liability Company.”

- Appoint a Registered Agent – Montana law requires every LLC to have a registered agent with a physical address in the state. This agent accepts official mail, DMV documents, and correspondence on behalf of your LLC. Many vehicle owners use professional registered agent services for this requirement.

- File Articles of Organization – Submit the Articles of Organization through the Montana Secretary of State’s online portal. The filing fee is currently $35, and the process can typically be completed within a day or two.

Step 2: Obtain an Employer Identification Number (EIN)

Next, you’ll need an EIN from the IRS.

- Why It’s Required – The EIN functions like a Social Security Number for your LLC. It’s necessary for tax reporting, setting up bank accounts, and in some cases, for insurance or financing in the LLC’s name.

- How to Apply – The IRS provides a free online application that issues your EIN immediately upon completion.

Step 3: Montana Address Requirement

To register a vehicle in Montana, your LLC must have a Montana mailing address.

- Why It Matters – The address is used for DMV correspondence, renewal notices, and delivery of registration documents and plates.

- Solution – Most people rely on their registered agent to supply a compliant Montana address.

Step 4: Purchase or Transfer the Vehicle

With your LLC formed, it’s time to place the vehicle under the company’s ownership.

- Buying New – When purchasing a new car, ensure that the buyer listed on the title or Manufacturer’s Certificate of Origin is your Montana LLC, not you personally.

- Transferring an Existing Vehicle – If you already own the vehicle, draft a notarized bill of sale transferring ownership from yourself to your LLC. Update all title paperwork so the LLC is officially recognized as the new owner.

Step 5: Complete Vehicle Title and Registration

Now you’ll formally register the vehicle under your Montana LLC.

- Prepare Documentation – Gather your notarized bill of sale, the vehicle’s title, and the Application for Certificate of Title (available from the County Treasurer’s Office).

- File with the County Treasurer – Submit the paperwork in the Montana county where your registered agent’s address is located. Some counties have lower fees, making them more favorable for registration.

- Receive Plates and Documents – Once approved, the Montana DMV will issue license plates and registration documents, which are mailed to your LLC’s Montana address.

Step 6: Annual Maintenance & Compliance

To keep your LLC and registration in good standing, ongoing maintenance is required.

- Renew the LLC – File your annual report with the Montana Secretary of State and pay the required fee to maintain active status.

- Renew Vehicle Registration – Vehicle registrations must also be renewed through the county on a yearly basis.

- Stay Compliant – Be mindful of potential insurance complications or scrutiny from your home state if you’re driving a Montana-plated vehicle out of state full-time. Compliance is key to avoiding penalties.

Section 3: Resources You’ll Need Along the Way

Here are the key resources to bookmark as you set up your Montana LLC and register your vehicle:

- Montana Secretary of State LLC Portal – File your Articles of Organization and manage annual reports.

- IRS EIN Application – Apply for your free Employer Identification Number.

- Montana DMV Vehicle Registration Page – Access forms, requirements, and DMV procedures.

- Registered Agent Services FAQs – Professional agents often provide detailed guides for LLC and car registration processes.

Common Questions About Montana LLCs for Cars

Can you set up a Montana LLC just to purchase a vehicle?

Yes. Many people form a Montana LLC solely for the purpose of buying and registering vehicles. The LLC acts as the full compliant owner, allowing you to take advantage of Montana’s no-sales-tax benefit. This is one of the most common reasons people establish a Montana LLC.

Can I start an LLC just to buy a car?

Absolutely. Montana doesn’t require your LLC to operate a traditional business. You can create an LLC exclusively to hold title to a car, RV, or collection of vehicles.

Can you register a car in Montana if you don't live there?

Yes. You don’t need to be a Montana resident to register a vehicle there. The key is forming a Montana LLC and using a registered agent with a physical Montana address. The LLC becomes the legal owner of the car, which makes you eligible for Montana registration and plates.

Can one Montana LLC own multiple vehicles?

Yes. A single Montana LLC can register and hold titles for multiple cars, motorcycles, RVs, or trailers. Many collectors and enthusiasts find this especially cost-effective since the annual maintenance and filing fees cover the entire LLC, not each individual vehicle.

Do LLCs pay taxes in Montana?

Montana LLCs themselves don’t pay a state-level income tax unless they elect to be taxed as a corporation. Instead, profits and losses typically pass through to the members, who report them on their personal tax returns. Importantly, Montana has no general sales tax, which is why registering a vehicle through an LLC there can be so cost-effective.

Setting Up a Montana LLC for Your Vehicle: A Step-by-Step Process

Setting up a Montana LLC for your vehicle is a straightforward process once you understand the steps. First, you form your LLC with the Montana Secretary of State, then obtain an EIN from the IRS. With a registered agent providing a Montana address, you either purchase or transfer the vehicle into the LLC’s name. From there, it’s a matter of filing the right paperwork with the county, receiving your Montana plates, and keeping up with annual renewals.

The benefits are clear: substantial tax savings, simplified registration, and added privacy for vehicle ownership. For collectors, exotic car owners, or RV enthusiasts, this strategy can mean thousands of dollars back in your pocket.

If you prefer not to handle the process yourself, many professional services and registered agents can manage filings, transfers, and renewals on your behalf. With Ride Legal, you get a concierge partner who makes starting a Montana LLC for cars both a smart financial move and a seamless experience.

Get Started with Ride Legal today and register with confidence.