Can You Register a Car in Montana Without Living There?

Yes. And here’s how.

The compliant doorway is referred to as a Montana LLC (Limited Liability Company). Instead of you personally registering the vehicle, the LLC becomes the official owner on paper. That means the state doesn’t need you to be a resident — your LLC holds that status for registration purposes.

As long as the LLC is properly set up, maintained, and in compliance with Montana law, the process is completely legitimate. Publications like Car and Driver have even reported on how widespread this practice is, especially for exotic and luxury car owners.

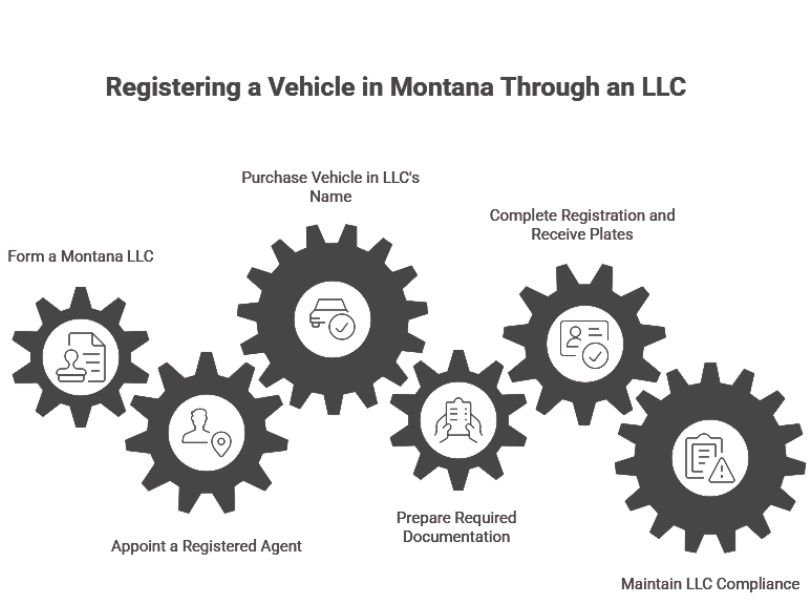

Step-by-Step: How It Works

Step 1: Form a Montana LLC

The LLC is the owner of the car. You don’t need to live in Montana, but you’ll appoint a registered agent with a physical Montana address. Services such as Ride Legal specialize in this.

Step 2: Appoint a Registered Agent

Your registered agent is your LLC’s local anchor. They receive official documents, manage state correspondence, and ensure your LLC stays compliant. Choosing the right agent is essential to keeping your business in good standing.

With Ride Legal, you not only get a professional registered agent but also access to concierge services that simplify the entire process — so you can focus on your business while we handle the details.

Step 3: Purchase the Vehicle in the LLC’s Name

The title and bill of sale must list the LLC as the buyer. This makes the LLC the owner eligible for Montana registration.

Step 4: Prepare Required Documentation

Gather the signed title, bill of sale, and proof of purchase under the LLC’s name. These documents are mailed to the county treasurer or a Montana registration service provider. According to the Montana DMV, online submission is not available for most forms.

Step 5: Complete Registration and Receive Plates

Once approved, you’ll receive Montana plates and official registration. Vehicles over 11 years old may qualify for permanent registration, meaning no annual renewals.

Step 6: Maintain LLC Compliance

Each year, you’ll file an annual report with the Montana Secretary of State.

Key Benefits of Montana Registration

So why go through the effort of forming a Montana LLC to register your vehicle? The payoff is significant — especially for high-value purchases.

No Sales Tax

Montana is one of the few states that doesn’t charge vehicle sales tax. That can mean tens of thousands in savings on luxury cars, exotic supercars, RVs, or even commercial fleets compared with states like California or Illinois.

No Inspections or Emissions Testing

Forget waiting in line for yearly inspections or emissions checks. Montana skips these entirely, making registration both faster and simpler.

Permanent Registration Available

For vehicles over 11 years old — including RVs, trailers, and motorcycles — Montana allows permanent registration. That means no annual renewal fees and no paperwork hassles year after year.

No Residency Requirement

You don’t need to live in Montana to register there. The LLC provides the residency stand-in, making the process accessible to anyone in the U.S.

Frequently Asked Questions, Answered.

Can you register a car in Montana if you live in another state?

Yes. You can register a car in Montana without being a resident by forming a Montana LLC. The LLC acts as the owner, allowing the vehicle to be registered in Montana even if you live elsewhere.

Can you register a vehicle in a state you do not reside in?

In most cases, no — but Montana is an exception. Thanks to its business-friendly laws, non-residents can use a Montana LLC as the owner of record. That satisfies the residency requirement for vehicle registration.

Will I have to file taxes for my Montana LLC?

No. A Montana LLC used exclusively for vehicle registration is considered an “asset-holding” LLC.

No Income = No Taxes

– If your LLC doesn’t generate income, there’s no need to file state or federal tax returns. The IRS doesn’t require filings for entities with no financial activity.Is there an Annual LLC Maintenance Fee? The only recurring fee is an annual report to keep your LLC active—this covers all vehicles under the LLC, not just one.

Do Montana plates comply with other state laws?

Yes. Montana plates registered under a Montana LLC are fully legal. The vehicle is properly registered in the state where its owner (The Montana LLC) resides.

Transfer Rule Exemptions

– Many states have laws requiring out-of-state plates to be transferred within 30 days, but these rules don’t apply to Montana LLCs. Your motorcycle’s legal “home” is in Montana, even if you live elsewhere.

– Remember that your LLC owns the vehicle, and can permit anyone to operate it regardless of where their driver’s license is issued.Law Enforcement: Law enforcement officers cannot stop or fine your LLC simply for having Montana plates unless there’s a clear traffic violation.

What is the Montana registration loophole?

The so-called “Montana loophole” refers to registering vehicles under a Montana LLC to avoid sales tax, inspections, and annual renewals. It isn’t really a loophole — it’s a recognized process, provided the LLC is properly formed and maintained.

Do you need a Montana address to register a car?

You don’t personally need a Montana address. Instead, your LLC must have a registered agent with a Montana address. That address serves as the anchor for your vehicle’s registration